By Gabriel Ameh

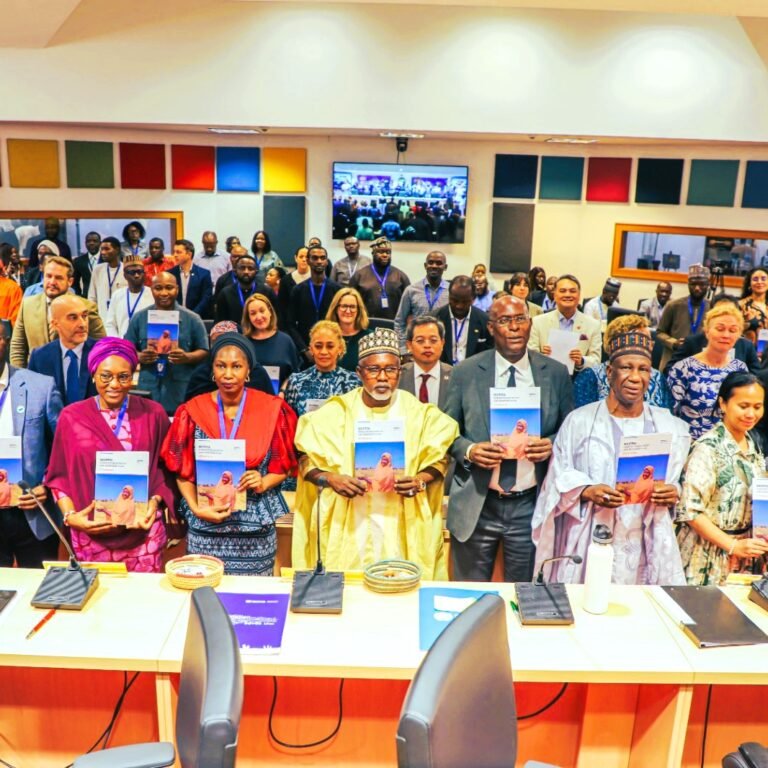

Journalists across the Federal Capital Territory (FCT) yesterday participated in a one-day capacity-building workshop on Nigeria’s evolving tax framework, organized by the Tax Justice and Governance Platform (TJ&GP) in partnership with the Civil Society Legislative Advocacy Centre (CISLAC).

The training, which held in Abuja, aimed to deepen journalists’ understanding of the country’s new tax reforms, equip them with the skills to analyze emerging gaps, and strengthen their ability to report complex tax issues in a clear and accessible manner.

Delivering the opening remarks, Nancy Humphrey welcomed participants and outlined the key objectives of the workshop. She emphasized the critical role of the media in shaping public understanding of tax policies and ensuring accountability in Nigeria’s fiscal system.

Humphrey noted that the consolidation of multiple tax regimes into a digital-first framework requires informed reporting to prevent misinformation and enhance civic engagement.

The first presentation, handled by Chinedu Bassey, focused on the Foundations of Nigeria’s New Tax Reforms. Bassey provided an in-depth breakdown of the consolidated Nigeria Tax Acts, highlighting their purpose, design, and expected impact.

He explained that the new unified tax code seeks to modernise tax administration, eliminate duplication, and boost Nigeria’s tax-to-GDP ratio. However, he also noted that successful implementation depends on strong institutional capacity and intergovernmental cooperation.

An expert-led analytical session was later delivered by Akin Adeniyi, who guided participants through a deeper examination of the gaps and challenges within the new tax law.

Adeniyi warned that while the 2025 tax consolidation is bold and long overdue, its unitary design conflicts with Nigeria’s federal structure. Without harmonization with the Taxes and Levies (Approved List for Collection) Act, he stressed, states risk losing control of vital revenue sources, potentially increasing fiscal dependence and sparking political tension.

Adeniyi also discussed the economic and citizen-level implications of the reform, including rising compliance costs for small businesses, increased audit activity, and possible double taxation concerns for foreign digital service providers. He emphasised that cooperative federalism not centralised enforcement will determine the reform’s long-term success.

During group sessions, journalists reflected on the media’s role as change agents in monitoring tax administration, advocating transparency, and ensuring justice within the FCT’s evolving tax landscape. Participants discussed strategies for improving public enlightenment and simplifying complex tax policies for everyday Nigerians.

The workshop concluded with a plenary session led by Isaac Botti and Chinedu Bassey, where groups presented their findings and shared reporting strategies. Organisers also presented a follow-up plan involving ongoing engagements and media dialogues to sustain awareness around Nigeria’s tax reforms.